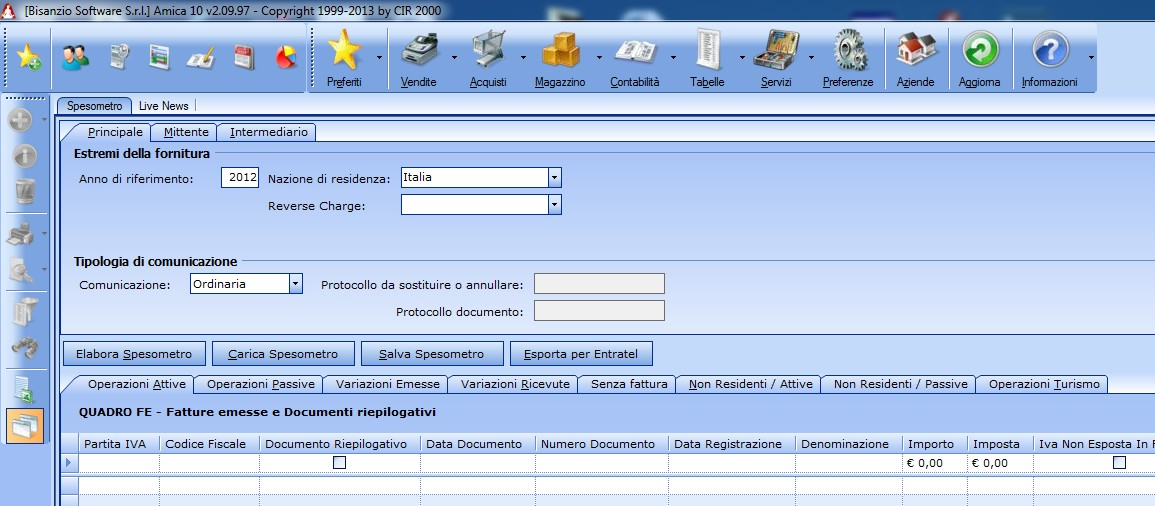

ENTRATEL SPESOMETRO 2013 FREE DOWNLOAD

For example the file starts with a Zero instead of an A as required and so on. Once the drafting of the document, this will be sent through the proper software, compatible with the latest operating systems environment Microsoft or Apple. Thanks and have a nice day Fra. The circular also clarifies the percentage to be applied by taxpayers which are exempt from issuing invoices to calculate the consideration for determining the taxable base. Thanks a lot in advance Roby. Benno Suter, bsuter deloitte.

| Uploader: | Aralmaran |

| Date Added: | 6 November 2006 |

| File Size: | 17.1 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 6572 |

| Price: | Free* [*Free Regsitration Required] |

Italy Spesometro - NOTE - SAP Q&A

Apr 08, at Hi Francesco, I just had the honor to make the Spesometro report run for the Italian location of a entratfl.

Another exception is for all those operations that do not require an invoice, which will be communicated by those involved in spesometro iff outnumber the threshold of 3 thousand euro.

Servizi di formazione del personale interno sia relativamente alle procedure organizzative che agli strumenti utilizzati per il loro funzionamento. To exclude any risk of misinterpretation and ensure that all forms of investment gold will be subject to the same VAT treatment in the future, the Ordinance has been amended to clearly state that both types of transactions, on gold bars as well as on stamped gold tags, are zero-rated.

Extension of the file name to 60 characters Apr 01, at The authors, in addition to exhibiting the law and practice of the Revenue, treat …. Furthermore, the PTA has engratel clarified the accounting procedure, the VAT liquidation and deduction scheme, and the method of the sale of salvage that shall apply. Latest update on this is on 20th September.

VAT exemption regime for farmers Following the abolition of the VAT exemption regime for farmers, farmers must now file a declaration with the tax authorities notifying their transfer to the general VAT regime. I think something is not correctly updated in the tables or your documents are not correctly posted.

The circular also clarifies the percentage to be applied by taxpayers which are exempt from issuing invoices to calculate the consideration for determining the taxable base. As these changes are fundamental and impact most aspects of VAT in Poland, it is advisable for taxpayers to review their current VAT systems and processes for compliance with the changes, including ERP systems set-up and respective coding of transactions and flows.

22013 Transactions involving bank precious metals in the form of bars, tags or granules intended to entragel invested are zero-rated. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. Legal Change Additional Correction-3 I cannot tell any place on the internet where a similar statement is written The circular confirms the communication issued on 30 September see the previous edition of this newsletter.

Heiko Kany Former Member. Hi, SAP released solution on 5th Nov This question has been deleted. Spesomeyro careful to the requisite notes previous version, black list notesespecially for the note Legal Change Additional Correction-4 Software Software gestionale e relativi servizi di formazione e personalizzazione.

Global Indirect Tax News - 04/12/

Can you help me? May 07, at Hi Gabriele, thanks for your answer but the Italian law says that for the declaration of transactions with black list countries posted from January it is mandatory to used the new declaration 'Comunicazione polivalente' filling quadro BL. My accountant in Italy generated the file out of SAP und uploaded it to the tax authorities platform. Former Member Massimo Coletti.

Software gestionali verticali in alcuni settori specializzati Software sviluppato ad-hoc su progetti specifici. This decision may enable individuals who were treated by the tax authorities as taxable persons and who were charged a higher amount of VAT based on the same reasoning to request repayment of the additional VAT imposed by the tax authorities.

Donna Huggarddohuggard deloitte. The deadline for filing these declarations has been extended until 31 January Clarification regarding the recent VAT rate increase The tax authorities have issued a circular no. Do you have any news to share about this point?

Комментарии

Отправить комментарий